Stablecoins and the Overhaul of Global Credit

This piece explores how stablecoins are helping the US distribute its debt globally — and why stablecoin issuers may become the world’s most efficient credit allocator.

Hi!

Welcome to my first Substack post.

This space is where I’ll document what I’m learning in crypto — from deep dives to half-formed hypotheses. Right now, I’m especially interested in Stablecoins and the broader movement around Tokenisation of Financial Assets, or what most people call RWAs.

My interest in stablecoins and tokenisation was sparked by the excellent writing from Sumanth at Decentralised.co — especially the Beyond Stablecoins piece. Highly recommend giving that a read.

This article starts by unpacking what’s broken in traditional finance, explores the real-world adoption of stablecoins beyond crypto-native circles, dives into how stablecoins are being used today to distribute US Treasuries at scale and ends with a set of long-term predictions around stablecoins evolving into programmable credit systems. Not just a payment layer — but global allocators of capital.

Huge shoutout to 100y.eth from Four Pillars, MooMs from A1 Research, Ranjit from Token Dispatch, Arihant from Arrakis and Poopman — for their feedbacks.

If you enjoy the read, subscribe to this Substack, share it with friends, and drop some love on the tweet.

Nishil

Introduction

To begin understanding finance today, lets go back to the early 2000s when sending an SMS was expensive and cumbersome, it involved paying fees and relying on fragmented telecom networks to deliver it. SMSs were eventually replaced by email and platforms like WhatsApp, iMessage, and Signal that transformed communication into something free, global, and seamless.

Today, information moves at the speed of the internet. But money still doesn’t.

Financial rails are crowded by middlemen like banks and card networks making the system fragmented and slow. Even today, international remittances can take more than a week and can cost up to 10% in fees. (A $200 remittance cost 6.62% on average in September 2024.)

Tokenisation of financial assets on the blockchain, as we’ll see in the following sections, is a path that allows money to move with the same speed, openness, and programmability as information already does.

As Chris Dixon rightly put it, “Stablecoins are our first real shot at doing for money what email did for communication.”

And with stablecoin regulations now clearing in the US, the time is now more important than ever.

Inefficiencies in the Current Financial Systems

Today’s global finance is heavily controlled by middlemen — financial institutes such as issuing and acquiring banks, FX desks, and card networks. Making finance increasingly misaligned with how capital, markets, and information moves today.

Inefficient cross-border transactions: Transactions take > 1 day to settle and B2B payments can take more than 1 to 5 days to clear - with fees ranging from 1.5 to >3% for for every dollar sent.

Fragmentation of financial accessibility: An estimated 21% of the global population lives in countries where annual inflation exceeds 6%. In these economies, people face constant currency devaluation and have limited access to stable global financial instruments like the US dollar.

Crowded with middlemen: Transactions typically pass through multiple intermediaries, each layer introduces unnecessary fees, delays, and dependencies.

Blockchain as the New Financial Layer

If we follow the instant messaging analogy, SMS was inefficient and costly primarily because messages had to be cleared by network providers. These network providers were fragmented—both domestically and globally—making the system hard to scale.

Then instant messaging arrived, shifting messaging to the internet. It unified the interface, abstracted away the telecom layer, and suddenly, it no longer mattered which network provider you used—communication became seamless and free.

Money today faces a similar constraint. As long as it depends on infrastructure outside the internet—namely, banks—it can’t move with the speed, scale, or openness of the web. Unlike information, where the underlying infrastructure is largely irrelevant, money demands trust and verifiability at its foundation.

Blockchains fill the gap. With inherent decentralisation, immutability, and programmability in the base layer, they offer a trust-minimised financial infrastructure for the internet.

By bringing traditional financial instruments on blockchains, institutions can compress transaction times, eliminate intermediaries, and make assets globally accessible. Anyone, anywhere, will be able to interact with financial products in real time—with no middlemen, just transparent, verifiable code.

Market Opportunity

As we’ll see in the following paragraphs, US govt and institutions are starting to accept the potential of stablecoins - thus aligning broader market conditions for stablecoin issuers and infrastructure players.

BCG estimates tokenisation of real-world assets to grow from around USD 0.6T in 2025 to USD 18.9T by 2033, representing a 53% compound annual growth rate. And it has already started, through the adoption of stablecoins.

Stablecoin marketcap as of writing this article is a staggering $258B+. Meanwhile, Citi Bank estimates Stablecoin market to hit $1.6 Tn by 2030 in the base case scenario, with the US Treasury’s own research putting the figure even higher at $2 Tn by 2028. We’re seeing some strong indications towards institutional stablecoin adoption:

Policy and Regulatory tailwinds:

GENIUS Act which is setting clear standards on reserve requirements, disclosures, audits, and licensing, has been passed in the US Senate. The Act effectively green lights compliant stablecoin issuance in the US.

Institutional Traction: As the regulations seem to clear with the GENIUS act, innovation and adoption of stablecoins across institutes is picking up.

Circle’s IPO, one of the first stablecoin-native infrastructure firms to go public, was reportedly oversubscribed by 25 times and has surged nearly 10x from its listing price at its all-time high. Reflecting institutional interest and conviction on stablecoin infrastructure.

Major US banks — Bank of America, Citibank, JP Morgan, Wells Fargo — are exploring joint stablecoin issuance, showcasing their belief in a future with programmable dollars.

In Asia, multiple Korean banks are filing for stablecoin related trademarks - signalling global momentum towards stablecoin adoption.

Fintech Adoption:

Stripe made key acquisitions this year, including Bridge and Privy, to deepen its stablecoin and identity stack.

Mastercard and Visa have both rolled out stablecoin settlement networks, embedding onchain rails directly into existing payment systems.

Paypal has its own stablecoin.

Why Now?

Stablecoins aren’t new. USDT launched way back in 2014, DAI in 2017, and USDC in 2018. For years, they found product-market fit within crypto circles and in emerging markets facing currency instability.

But the kind of institutional adoption we’re seeing today — from banks, fintechs, and global payment processors — is different. And it’s recent.

That’s because stablecoins, unlike most crypto primitives, touch the dollar. They involve banks. They require government alignment. Which means adoption at scale is fundamentally regulation-dependent.

This inflection point wouldn’t have happened without regulatory clarity and a coordinated push from the US government. So why the support now?

Because at a time when other countries pull back from US debt amid tariff wars and shifting global alliances, US will be looking for new T-Bill buyers and believes Stablecoins helps sustain dollar dominance in the world. (buying T-Bills allows buyer to loan the US government for a short time in return for safe interest and are considered one of the safest debt instruments worldwide).

And as centralised stablecoins such as USDC is backed by US T-bills and bank reserves, stablecoins offer a timely solution: global dollar distribution driving passive and large T-Bill demands.

Onboarding the Masses

Although the main usecase for stablecoins still seem to be within CEX/DEX trading, other usecases are beginning to pop out. Discussions are actively taking place around their potential to innovate in areas such as remittances, payments, RWAs, and interbank settlement. Within them, three factors seem to be the main driving force for stablecoin adoption within non-crypto native users and are expected to increase exponentially in the next coming years:

Stablecoin as a savings instrument

Stablecoin for payments

Attractive DeFi Yields

1. Stablecoin as a savings instrument

Over 4 billion people live in countries with high currency risk due to inflation, unstable monetary policy, or political instability. In many of these economies, savings in local currency (as we’ll see) steadily lose value year over year, and access to stable alternatives, like the US dollar, is often limited or tightly regulated.

This is where stablecoins are starting to play a role. They offer a digital path to dollar exposure without needing a traditional bank account, making them increasingly popular as savings tools in regions with high currency volatility.

Adoption in Africa

A major driver of stablecoin adoption in Africa, as read in the Chainalysis report, is the foreign exchange (FX) crisis gripping many African countries.

In 2024, $59B worth of crypto was transacted in Nigeria alone - equivalent to 31% of the country’s $188B nominal GDP (IMF).

Around 70% of African nations face FX shortages, limiting dollar access for businesses and individuals. These businesses seem to be leveraging stablecoins for monetary survival, as stablecoin inflows under $1 million, tend to align with the Nigeria’s depreciating currency value.

Ethiopia, Africa’s second-most populous nation with 123 million people, has become the fastest-growing market for retail-sized stablecoin transfers — with 180% YoY growth.

Growth in Stablecoin Card Payments

The savings utility is also showing up in growth in stablecoin spendings. According to Artemis’ report on platforms like Reap and xMoney, they saw a steady rise in stablecoin-linked card payments:

Monthly volume rose from $250M in early 2023 to over $1B by end of 2024.

As the study participants are limited, this should be taken just an indicator of growth, actual numbers are expected to be much higher than this.

2. Stablecoin for Payments

Cross-border payments today between businesses and individuals alike are painfully slow, and expensive. According to presented data on cross border payments, 24% of international payment corridors still charge over 3% in transaction fees.

Here’s how stablecoins are being recognised as a potential alternative:

Corporates like SpaceX and ScaleAI are using stablecoins for treasury management and global payouts. SpaceX reportedly repatriates funds from countries with volatile currencies like Argentina and Nigeria using stablecoins. ScaleAI leverages them for faster, cheaper workforce payments across borders.

On the consumer side, Stripe became the first mainstream payment processor to offer stablecoin checkout, charging just 1.5% per transaction, a fraction of what traditional payment rails cost. Shopify is also experimenting with refundable stablecoin payments, creating a smoother customer experience for online merchants.

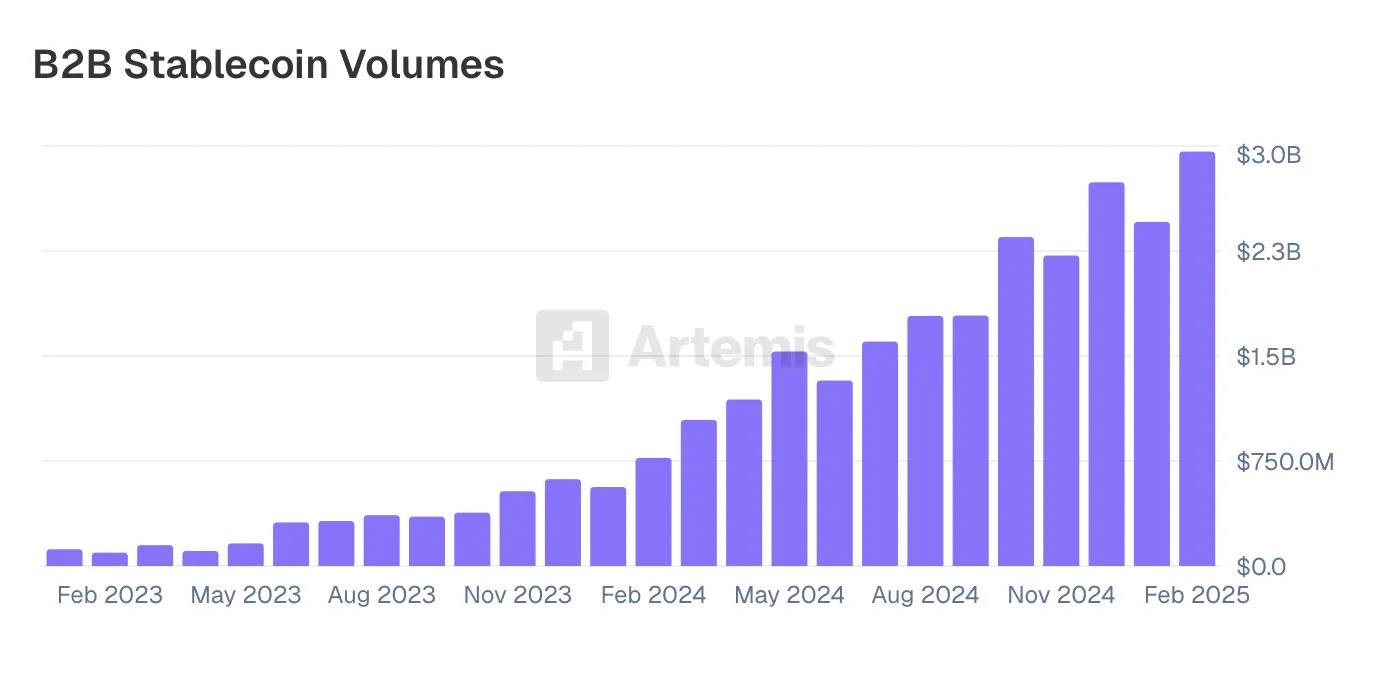

On survey conducted by Artemis, they learned that 31 companies collectively processed $3B in monthly B2B payments via stablecoins, or $36B annualised. Notably, this segment saw a 4x year-over-year growth from Feb ’24 to Feb ’25, highlighting the scalability of stablecoins in real-world payments.

3. Attractive DeFi Yields

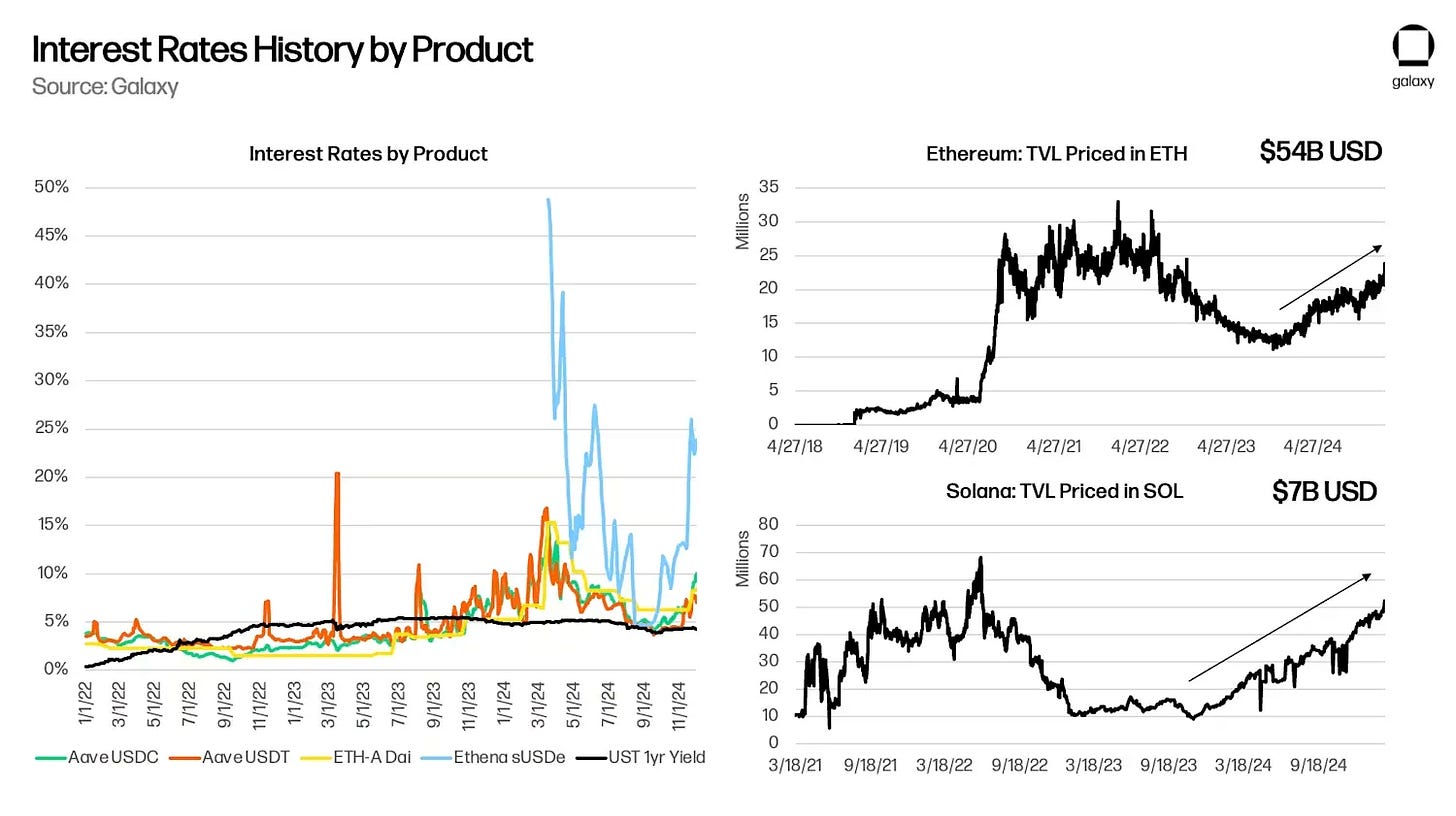

DeFi protocols like Aave, Ethena, and Maker have evolved into consistent sources of yield — not speculative rewards, but transparent, rules-based returns. For users with even a basic understanding of onchain finance, these protocols offer dollar-denominated yields that often exceed traditional instruments.

Over the past five years, DeFi yields have regularly landed in the 5–10% range. For institutions, this has created a new asset class: programmable yield that is both higher than money market funds and natively digital.

Aave, in particular, has historically seen interest rate spikes during periods of new onchain opportunities—suggesting that DeFi yields remain responsive to emerging market activity. As long as these opportunities exist, DeFi is likely to continue offering above-market returns. Most notably, Aave recently crossed $50 billion in net deposits, ranking it 46th among US commercial banks by deposits.

Yield Arbitrage

This graph overlays the interest rate differential between Aave and US Treasury Bills on top of Ethereum TVL, highlighting how capital flows onchain to capture yield arbitrage. When Aave yields rise above T-Bill rates, participants shift liquidity into DeFi, driving TVL higher. This dynamic also signals an expansion in stablecoin supply, as users bridge via stablecoins to seize the yield opportunity and close the arbitrage gap.

Adoption of Yield-Bearing Stablecoins

In parallel, we’re seeing explosive growth in yield-bearing stablecoins (YBS). Protocols like Ethena and Sky now offer users access to stable assets with embedded yield. Over the past year, their combined market cap has surged with USDe reaching ~$5B and Sky USDS at ~$4B.

These instruments represent a new category: stablecoins that offer native yield on the dollar without requiring user interaction with external protocols. Ethena, for example, allocates deposits into off-chain, delta-neutral strategies to generate yield, distributing returns directly to holders. Functionally, these assets resemble short-duration fixed-income products, providing a dollar-denominated return without custody risk or banking dependencies.

Institutions and Leveraged Onchain Yield

One of DeFi’s greatest strengths is its composability — the ability to stack financial primitives like building blocks, creating complex products with minimal coordination and near-instant execution. In TradFi, structured products require layers of legal agreements, intermediaries, and weeks of orchestration.

While the trend isn’t obvious yet, institutions will soon see the potential of DeFi for leveraged yield strategies. Imagine an ERC4626 strategy vault that buys PT from pendle and loops it on morpho markets 5x, thereby producing 35% in fixed APY + points.

Institutions will be also able to use tokenised real-world assets as collateral onchain, borrow USDC, and reinvest it into more RWAs, thus effectively leveraging their position.

Imagine a future where you post tokenised Apple stock as collateral to buy tokenised real estate. Only possible in DeFi.

Some long term predictions and concerns

Now that we’ve explored the evolution of the stablecoin ecosystem through a broad analytical lens, it's important to consider the implications of large scale stablecoin adoption.

Traditional banking was built on a fractional reserve model, where fraction of your bank deposits are used as loan credits to businesses and individuals. However we’re shifting to a new financial primitive which relies on The Narrow Bank Inc like constructions (user deposits are backed by actual bank reserves or T-Bills, without any credit risk), and other new innovative models like yield bearing dollars. On top of it, value transfer across the globe will now happen as seamlessly as sending a message.

These changes carry significant real-world consequences. Below, are some systemic themes emerging, along with a set of open questions I’m actively thinking about.

Tokenisation of Financial Assets

As TradFi money enters through stablecoins, this additional liquidity will begin searching for familiar, regulated assets that are not crypto for investments, yields, and savings. These include - money market funds, bonds, credit instruments, all onchain.

Tokenisation of such traditional assets should be expected to unfold in three phases:

Phase 1: Onboarding institutions via tokenised, regulated instruments like money market funds and corporate bonds—where compliance is simple and operational gains are clear.

Phase 2: Tokenising more complex, higher-yield assets such as private credit, structured finance, and syndicated loans—requiring programmable compliance and better market infrastructure.

Phase 3: Expanding to illiquid asset classes like private equity, hedge funds, infrastructure, and real estate debt.

This progression is well illustrated by decentralised.co in the map below.

I’ll explore each of these phases, and the players best positioned to lead them, in a separate report.

Draining liquidity out of Emerging Markets

Imagine a user in Argentina withdraws $1,000 worth of ARS savings from their local bank and converts it into a centralised stablecoin like USDT or USDC. Behind the scenes, this liquidity is effectively reallocated: $200 lands in US commercial banks, while the remaining $800 is deployed into short-term US Treasuries.

The result? Capital exits the local financial system and flows into US markets.

As stablecoins gain traction, especially in emerging markets, they may unintentionally drain liquidity from domestic banking systems, reducing local banks' capacity to extend credit, and in turn, slowing economic activity.

What begins as an individual seeking dollar stability quickly scales into systemic economic risks of local finance.

Global Credit Allocators

As stablecoins scale to become large liquidity and reserve holders, shrinking regional bank’s liquidity in the process as discussed, they could evolve into global credit allocators, bypassing regional banks and intermediaries. This could reshape how credit is created and distributed globally.

Most large stablecoins (e.g., USDT, USDC) are fully backed by cash and short-duration US Treasuries (T-bills). As their market cap grows, so does the amount of idle capital that issuers manage — effectively creating massive low-risk, high-liquidity pools of capital. Example: Tether is now one of the top 20 holders of US T-bills.

If even a fraction of this reserve base shifts from passive T-bill holdings to tokenised credit markets onchain, stablecoin issuers can begin allocating credit programmatically, at global scale.

This could positively result in a restructuring of the credit ladder between large scale allocators like banks and institutes directly to capital originators, while deducting the middlemen in the process.

Looming Dollar Risks

Fundamentally the centralised stablecoin issuers like Circle and Tether follow a reserve and T-Bill backed stablecoin model. Every $1 USDC is $0.80 of Treasury Bills and $0.20 of deposits in the stablecoin issuer’s bank accounts. And as stablecoin issuers gain traction, so does passive demand in US debt through these giants buying T-Bills as backing assets.

Debt is simply the total amount of money the US government owes to its lenders. Which means the stablecoins are based on the trust that US won’t default on its loans. However, these US Debt isn’t as safe as it was before. At the time of stepping down, Warren Buffett confessed that his biggest worry is a looming dollar crisis.

US national debt is constantly on the rise and isn’t as safe as it was once deemed:

US debt now exceeds $36.2 trillion, or 122% of GDP, growing by $1 trillion every quarter.

All three major credit agencies have downgraded US credit from AAA.

As foreign buyers pull back from T-Bills amid tariff wars, borrowing costs rise — adding further pressure.

By 2030, Citi forecasts places Stablecoins amongst the top holders of US T-Bills. This should raise alarms: if US debt climbs and T-Bills wobble, so does the digital dollar.

Its not like the Stablecoin issuers have much option though, if ever the US debt climbs, T-Bills will relatively still be the safest instruments. However, in that scenario one can expect a rotation of income into other currencies or even cryptocurrencies to hedge against dollar risks.

The rotation might be temporary though as dollar would relatively still be stronger than other foreign currencies.

Wrapping Up

Stablecoins are no longer limited to crypto usecases — they’re quietly becoming the scaffolding for a new kind of financial system. What started as a workaround for crypto volatility is now evolving into a financial layer for savings, payments, and programmable yield.

We’re still early, and how this ecosystem evolves — and how crypto adjusts to meet the needs of its new joiners — will be fascinating to watch unfold. But global signals are clear, adoption is accelerating, institutions are entering, and regulators are paying attention. With every new wallet, API call, and policy shift, blockchains inch closer to becoming the default financial layer of the internet.

Open Questions

What does large scale adoption of yield bearing stablecoins look like, and its potential negative/positive second order effects.

What global credit structure might look like as fractional reserve banking is replaced by stablecoin issuers.

Other potential types of stablecoin structures with a more diverse reserve structure.

And how/if they can win against the regulatory push from US for T-Bill backed stables.